Diminished Value After an Accident — What It Is and How to File a Claim

A diminished value claim asks an insurer to pay the difference between what your vehicle was worth before a crash and what it’s worth after repairs — the discount buyers attach to a car with a collision history. This guide breaks down what diminished value means, why accident-related depreciation can cut resale or trade-in offers, and the straightforward steps you can take to document and file a claim. You’ll learn how insurers and appraisers measure diminished value, the three common claim types—immediate, inherent, and repair-related—and how certified repairs and clear paperwork can shrink long-term losses. We also walk through the appraisal and paperwork process, show how a repair shop can help gather evidence, and answer common timing and partial-fault questions. If you’re wondering whether to pursue a diminished value claim after a crash, this piece gives clear definitions, examples, checklists, and step-by-step guidance so you can move forward with confidence.

What is diminished value and why it matters after a crash

Diminished value is the drop in a vehicle’s market price caused by a recorded accident — even after the car looks and drives like new. Buyers and dealers often pay less for cars with collision history because they worry about hidden damage, future repairs, or safety issues. For owners, diminished value directly affects trade-in offers and private-sale prices; recovering it can offset the financial hit from an accident. The amount of loss varies by make, age, and damage severity, so accurate appraisals and solid documentation are key. High-quality repairs that follow OEM procedures and clear, itemized records help show the car was restored properly and can reduce the perceived value gap.

How is diminished value defined in insurance claims?

Insurers typically define diminished value as the difference between the vehicle’s fair market value right before the collision and its value after repairs and the accident is disclosed. Adjusters look at comparable sales, mileage, overall condition, and repair records to estimate post-repair market value, sometimes using standard formulas or guides. From your side, diminished value can include measurable price drops and the intangible buyer hesitation that follows an accident. Strong evidence — comparable listings, detailed repair invoices, and independent appraisals — makes a claim more persuasive. For example: if your car was worth $20,000 before the crash and similar cars with accident history sell for $18,000, that $2,000 gap is the starting point for a diminished value estimate, adjusted for other factors.

Why do owners lose value after an accident?

Buyers and dealers often reduce offers for cars with a reported accident because the history raises questions about structural soundness, future repairs, and long-term reliability. Even flawless-looking repairs can’t always erase a history report, and that disclosure lowers demand. Modern vehicles with ADAS, complex structures, and precise OEM repair methods make buyers especially cautious — improper repairs or missed recalibrations can affect safety and performance. That leaves owners dealing with two costs: the repair bill itself and the lingering market penalty. Transparent documentation and certified repairs reduce that perceived risk and help restore buyer confidence.

- Common reasons buyers discount vehicles with accidents:

Risk of hidden structural or mechanical damage.

Worry about aftermarket or substandard repairs.

History-report entries that discourage buyers.

Those points show why thorough documentation and certified repair processes matter. Next, we’ll explain the three types of diminished value claims and how each one works.

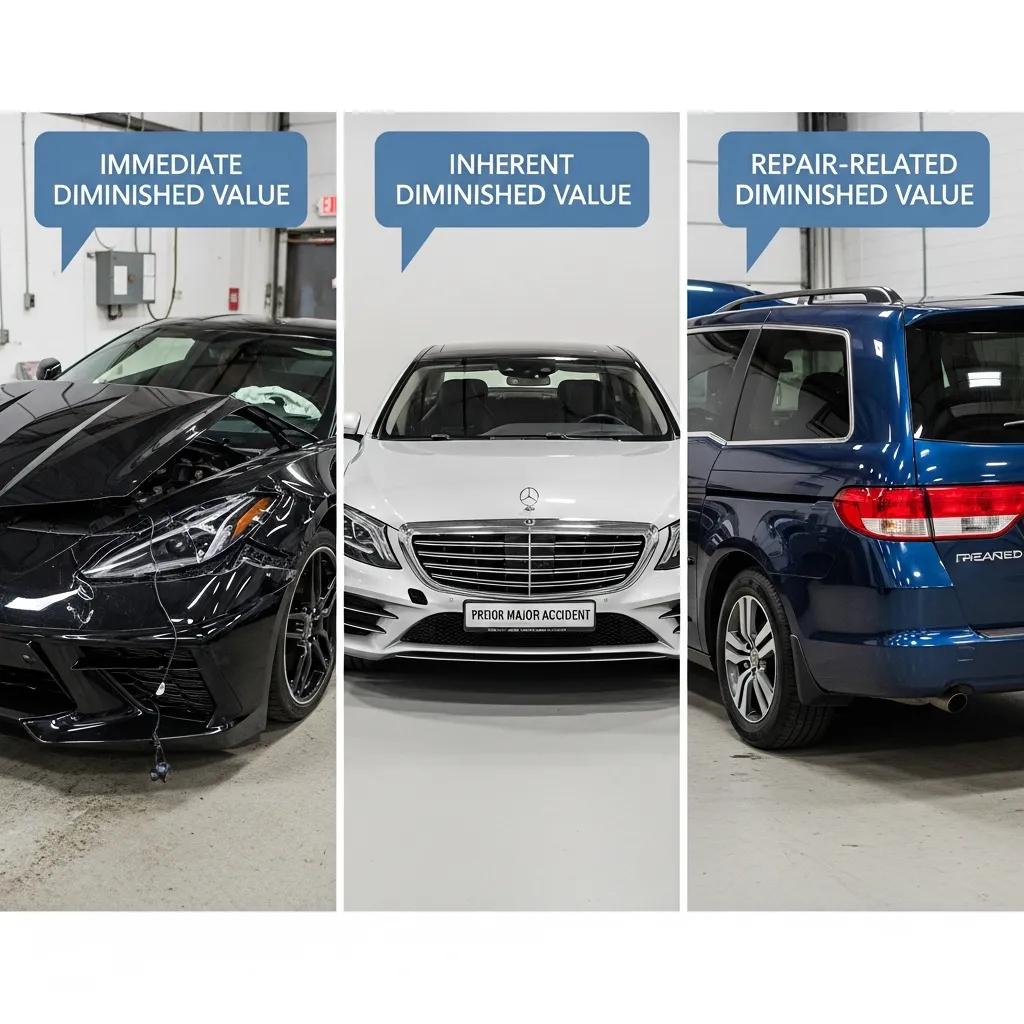

What are the types of diminished value claims?

Diminished value claims usually fall into three categories: immediate diminished value, inherent diminished value, and repair-related diminished value. Each describes a different way a vehicle can lose market worth, and each requires different evidence. Immediate diminished value covers the short-term price drop right after a crash and before repairs. Inherent diminished value is the long-term stigma from having an accident on record. Repair-related diminished value focuses on how repair quality or missing documentation affects resale value. Knowing which type applies helps you collect the right evidence and time your claim correctly.

The table below compares these types so you can see how they differ.

| Type of Diminished Value | Cause / When It Applies | Typical Impact / Example |

|---|---|---|

| Immediate diminished value | Market reaction right after the accident, before repairs are finished | Lower private-sale offers in the short term; example: a temporary 5–15% drop on comparable listings |

| Inherent diminished value | Ongoing stigma from a documented accident, regardless of repair quality | Persistently lower trade-in or resale offers over the vehicle’s life |

| Repair-related diminished value | Perceived or real value loss from non-OEM repairs, missing documentation, or poor workmanship | Smaller offers or lower appraisals when repairs aren’t verifiable; example: discount due to aftermarket parts |

This makes it clear that your claim approach and the evidence you gather should match the diminished value type you’re pursuing. The next sections explain how OEM-certified repairs and appraisals affect results.

What is inherent diminished value and how does it affect resale?

Inherent diminished value is the lingering drop in market value tied to an accident history itself — even when repairs were done correctly. Dealers and private buyers factor accident records into resale expectations, often offering less once the collision is disclosed on vehicle history reports. The impact depends on the car’s age, popularity, and how severe the accident was: newer, in-demand models may hold value better than older economy cars, but any reported collision can reduce competing offers. Detailed repair records and transparency help soothe buyer concerns, but some residual stigma often remains.

How does repair-related diminished value affect worth?

Repair-related diminished value happens when buyers or appraisers doubt the quality or completeness of repairs — for example, if non-OEM parts were used, calibration steps were skipped, or documentation is vague. OEM-quality repairs, genuine parts, and ADAS recalibration provide stronger proof that the vehicle’s safety and performance were restored, which lowers the repair-related penalty. Documents that help include OEM repair protocols, parts invoices, and technician certifications. Shops that provide clear, itemized repair records listing OEM parts and certified technicians usually get better responses from appraisers and insurers than those with vague invoices.

| Repair Action / Service | Certification / Procedure | Benefit to Safety / Resale / Insurance Credibility |

|---|---|---|

| OEM parts installation | Manufacturer-specified parts and fitment | Maintains factory fit and function; improves resale confidence |

| ADAS calibration | Performed to OEM calibration procedures | Restores active safety systems; reduces future liability concerns |

| Technician certification | I-CAR Platinum-level training noted | Shows advanced skills and reassures insurers and buyers |

| Detailed repair documentation | Itemized invoices and procedure references | Strengthens diminished value appraisals and insurer verification |

That mapping shows why repair quality and traceable workflows matter — they can materially reduce perceived loss and support a stronger diminished value claim.

How does Prime Time Collision Center reduce diminished value with OEM-certified repairs?

At Prime Time Collision Center, we prioritize OEM-quality repairs, detailed documentation, and certified technicians to limit repair-related diminished value and improve appraisal outcomes. Using OEM repair plans, genuine parts, and trained staff creates a clear repair history that shows safety systems and factory tolerances were restored. Appraisers and insurers recognize credentials like I-CAR Platinum and OEM certifications when they evaluate a vehicle’s post-repair value. We also help with insurance coordination, offer free estimates, and provide 24/7 towing — all services that speed evidence collection and reduce delays that can complicate a diminished value claim.

The table below links specific repair services to their certification and the value they add when assessing diminished value.

| Repair Action / Service | Certification / Procedure | Benefit to Safety / Resale / Insurance Credibility |

|---|---|---|

| Structural alignment | Work performed to OEM repair plan | Restores chassis integrity; important for appraisal credibility |

| Genuine parts replacement | OEM parts used where specified | Preserves original performance and fit |

| ADAS recalibration | OEM calibration standards followed | Ensures active safety systems work as intended |

| Technician training | I-CAR Platinum-certified technicians | Demonstrates advanced skills and reduces insurer pushback |

Documented OEM processes and certified technicians translate to real benefits for safety and resale value. If you want to minimize diminished value, choose a repair partner that provides these services and clear, itemized records — it improves the odds of a favorable appraisal and insurer recognition.

What do I-CAR Platinum Certified Technicians bring to repairs?

I-CAR Platinum certification means a technician has finished advanced training across collision repair areas — structural work, mechanical systems, and vehicle electronics that matter on modern cars. That training helps technicians follow OEM procedures, perform accurate alignments, and handle complex tasks like ADAS recalibration. When an appraisal cites repair quality, documentation showing I-CAR Platinum involvement adds credibility. Including technician credentials in your repair records helps set properly executed repairs apart from less thorough work and can reduce repair-related diminished value.

How do OEM-certified repairs protect safety and resale value?

OEM-certified repairs follow manufacturer-approved methods, use specified parts, and include factory calibration steps. Those practices restore a vehicle to its intended performance and safety standards, lowering the likelihood of hidden issues and giving buyers reason to pay closer to market value. Detailed records of OEM procedures, parts, and calibrations provide appraisers and insurers with the evidence they need to see the vehicle’s integrity was restored — which narrows the diminished value gap. Making OEM-certified workflows and traceable documentation a priority is a practical way to protect both safety and market value after a crash.

How to file a diminished value claim: steps and what insurers want

Filing a diminished value claim takes good documentation, prompt action, and an understanding of how insurers judge post-repair market value. The typical process includes getting an itemized repair estimate and final invoice, ordering an independent diminished value appraisal or market comparison, collecting vehicle history and pre-accident value data, and sending a clear claim packet to the insurer with all supporting evidence. Timing matters: save pre-repair photos, repair receipts, and appraisal reports early so you can show the before and after. A well-organized package — invoices showing OEM procedures, technician certifications, and comparable listings — makes it easier to justify your diminished value number to an adjuster or appraiser.

- Obtain an itemized repair estimate and final invoice that lists parts, labor, and procedures.

- Request a diminished value appraisal or market comparison from a qualified appraiser.

- Gather vehicle history reports and pre/post-repair photos to document condition and disclosure.

- Submit a written diminished value claim to the insurer with your supporting documents and a clear calculation.

These steps form the practical path for a claim. The table below explains the role each document plays.

| Document | What It Shows | Why It Helps the Claim |

|---|---|---|

| Itemized repair invoice | Parts used, labor performed, and procedures followed | Proves OEM compliance and repair scope |

| Diminished value appraisal | Market comparables and valuation method | Gives an independent basis for the requested amount |

| Vehicle history report | Accident record and prior listings | Establishes disclosure status before and after the repair |

| Pre/post-repair photos | Visual evidence of damage and repair quality | Supports the story that repairs were completed properly |

A strong claim ties these records together. Insurers are more likely to accept a diminished value number when the evidence clearly shows both market impact and the repair work that addressed safety concerns.

What documentation do I need to support a diminished value claim?

To build a solid diminished value claim, assemble an appraisal or market-comparison report, a detailed repair invoice listing OEM parts and procedures, vehicle history reports showing pre-accident value, and clear pre- and post-repair photos. Each piece matters: appraisals quantify the market gap, repair records prove what was done, history reports show disclosure effects, and photos provide visual context. Extra support like ADAS recalibration records or technician certifications directly addresses safety and repair quality concerns that appraisers consider. Present these materials in a tidy packet with a brief cover summary to speed insurer review and strengthen your negotiating position.

How does Prime Time Collision help with claims and appraisals?

Prime Time Collision Center helps customers by providing clear, itemized estimates and final invoices that document OEM procedures, parts used, and technician involvement — the exact records appraisers and adjusters look for. We offer free estimates and 24/7 towing to help secure timely documentation right after an accident. By coordinating with customers and insurers on repair scope and supplying detailed repair files, Prime Time Collision Center smooths the claims process and reduces delays that can weaken a diminished value case. If you need help understanding how repair documentation supports a diminished value claim, our focus on OEM-certified workflows and certified technicians is a practical advantage during negotiations.

Frequently asked questions

What factors influence the amount of diminished value I can claim?

The diminished value amount depends on several things: your vehicle’s pre-accident market value, how severe the damage was, the quality of the repairs, and the make and model. Market conditions and buyer perceptions also matter — luxury cars often suffer higher percentage drops than economy models. The best way to maximize a claim is to collect thorough documentation, including a professional appraisal and detailed repair records.

How can I determine the pre-accident value of my vehicle?

Use online valuation tools like Kelley Blue Book or Edmunds for estimates based on make, model, year, mileage, and condition. Check recent local sales of similar vehicles for real-world comparables. Any prior listings, invoices, or appraisals that show the car’s condition before the crash will help establish a solid baseline for your claim.

What should I do if my insurer denies my diminished value claim?

If your insurer denies the claim, start by reviewing the denial to understand why. Gather additional evidence — independent appraisals, market comparables, or further repair documentation — and submit an appeal. Speak with the claims adjuster to clarify next steps. If the denial stands and you believe it’s unjustified, consider getting professional help from a diminished value specialist or legal advisor.

Are there specific timelines I need to follow when filing a claim?

Yes — act quickly. File your claim soon after repairs are complete so evidence remains fresh. State statutes of limitations vary, so preserve dates for the accident, repair estimates, repair completion, and appraisals. If you’re unsure about local deadlines, check with a claims professional or attorney to avoid missing any limits.

Can I file a diminished value claim for a leased vehicle?

Yes, but the process can differ because the leasing company technically owns the vehicle. Your lease agreement may require the lessor to file the claim or dictate how repairs are handled. Check the lease terms and coordinate with the leasing company — documentation of the vehicle’s condition and repairs is still essential.

What role does a diminished value appraisal play in my claim?

An independent diminished value appraisal is often the most persuasive piece of evidence. Appraisers evaluate pre-accident value, repair quality, and market conditions to estimate the value loss. A professional appraisal gives you an objective, defensible number to present to the insurer and strengthens your negotiating position.

Can I file a diminished value claim if I was partially at fault?

Often, yes. Recovery may be reduced by the percentage of fault assigned under your state’s rules. Some states follow comparative negligence principles that affect recoverable amounts. Because partial-fault cases add complexity, keep thorough documentation — appraisals, repair records, and photos — to show the loss caused by the other party. If fault allocation is disputed, consider hiring an appraiser or seeking legal advice to protect your claim.

What is the typical statute of limitations for diminished value claims?

Statutes of limitations vary by state and by the legal basis of your claim, so there’s no single nationwide deadline. As a practical approach, act fast: collect repair estimates, get appraisals, and submit claims promptly to preserve evidence and avoid procedural bars. Track dates for the accident, repair estimates, repair completion, and appraisals so you can confirm applicable deadlines. If you’re unsure, consult a local claims professional or attorney.

Key timing tips:

- Take pre-repair photos and get estimates immediately after the accident.

- Order a diminished value appraisal soon after repairs are finished.

- Submit your claim with supporting documents as soon as you have the evidence.

Following these steps protects your ability to seek compensation and preserves the strongest possible evidence for a diminished value claim.

Wrap-up

Diminished value claims matter — and with the right records and repairs, you can recover part of the loss a crash causes to your vehicle’s market value. Document the repairs, insist on OEM procedures when appropriate, and collect a professional appraisal to strengthen your case. If you’d like help gathering the right paperwork or understanding your options, reach out to a qualified professional who can guide you through the process.