Understanding Personal Injury Protection (PIP): A Practical Guide to Benefits and Claims

Personal Injury Protection (PIP) is an auto insurance add‑on that helps pay medical and related out‑of‑pocket costs after a car accident — often before fault is decided. This guide breaks down what PIP typically covers, how it works with other coverages, and step‑by‑step advice for filing a PIP claim so injured people get timely care and reimbursement. Confusion over medical bills, lost wages, and coordination with health insurance is common after a crash; knowing how PIP works can cut delays and help protect your recovery and finances. Below we cover PIP basics, state differences (including California and no‑fault systems), a clear list of typical benefits, a practical claim workflow with documentation checklists, and how a local collision partner can help coordinate repairs and claims. Throughout, you’ll find actionable tips and example scenarios to help you file accurately and work with providers and insurers to resolve injury‑related expenses.

What is Personal Injury Protection Insurance and How Does It Work?

Personal Injury Protection (PIP) is an auto insurance benefit meant to cover immediate medical bills and related losses after a vehicle crash, regardless of who caused it in many states. PIP typically pays qualifying medical expenses, a portion of lost income, and certain household services up to your policy limits, reducing reliance on health insurance for accident care. Because PIP can pay quickly, it often speeds access to treatment and reduces out‑of‑pocket delays that might slow recovery. Whether PIP is central to your claim depends on whether your state follows a no‑fault or fault system, and on your policy’s definition of “covered persons,” so check your policy language before filing.

PIP usually applies to the policyholder, occupants of the insured vehicle, and in some cases pedestrians hurt by the insured vehicle; exact eligibility is set by your policy and state law. The next section compares how PIP appears across states and how it stacks up against MedPay and health insurance so you know who pays first in different situations.

Here’s a quick look at PIP’s core coverages:

- Medical expenses for accident‑related treatment that are billed and reimbursable under your policy.

- Lost wages or income replacement for time missed from work due to injury.

- Reasonable services and rehabilitation costs like physical therapy or household help when needed.

These items shape what you’ll document and submit during a claim — we cover that process in later sections.

What Does PIP Insurance Cover in No‑Fault and Other States?

In no‑fault states, PIP acts as the primary payer for accident medical costs and some nonmedical expenses, letting injured people access benefits without proving fault. Typical PIP benefits include emergency transport, hospital and doctor visits, prescriptions, and short‑term rehab, with state laws or policy limits setting timelines and caps. In fault‑based states, PIP may be optional or not offered; injured parties often turn to liability claims against the at‑fault driver, MedPay, or health insurance for bills. State rules differ, so confirm local regulations and your policy terms — if you’re injured out of state, different rules may apply and affect how fast reimbursements arrive.

Example: In a no‑fault state a passenger might get PIP payments for therapy while fault is still being sorted. In a fault state, that passenger could have to wait for a third‑party claim against the at‑fault driver, which can delay payment. Knowing these differences helps you prioritize documentation and treatment timelines to protect eligibility.

How Does PIP Differ from Other Auto Insurance Coverages Like MedPay?

PIP and MedPay both help with medical costs after a crash, but they differ in scope and how they interact with other payers. PIP commonly covers medical bills plus lost wages and certain services; MedPay usually covers only medical payments and often has lower limits. In no‑fault states PIP often pays first and may coordinate with health insurance, while MedPay typically supplements other coverage regardless of fault. Liability coverage, by contrast, pays for injuries you cause others and can cover damages beyond your own medical bills. Understanding these distinctions tells you which paperwork to gather and which insurer or provider to contact first when urgent treatment or repair coordination is needed.

Coordination rules vary — some PIP plans reduce health insurance payments or include subrogation rights that may require repayment if another party is later found responsible. The next section breaks down typical PIP benefit categories so you can document claims clearly.

What Does PIP Coverage Typically Include After a Car Accident?

PIP usually covers several core benefit types aimed at immediate recovery and short‑term financial support: medical expenses, rehabilitation and physical therapy, lost wages or income replacement, and essential services like household help or childcare if your injuries prevent normal activities. Some policies may cover reasonable funeral costs, but property damage and pain‑and‑suffering are normally excluded from PIP and handled through other coverages or legal claims. Prompt medical care, clear documentation, and timely filing improve approval chances and speed reimbursements.

The table below maps common PIP benefit categories to what they typically include and why they matter.

| Benefit Category | Typical Attribute | Practical Value |

|---|---|---|

| Medical Bills | Covers ER care, hospital stays, doctor visits, prescriptions | Reduces out‑of‑pocket costs and gets you treated faster |

| Rehabilitation | Physical therapy, occupational therapy, durable medical equipment | Helps you recover function and return to work |

| Lost Wages | Portion of pre‑injury income or a capped weekly amount | Replaces income lost while you recover |

| Essential Services | Childcare, housekeeping, in‑home help when injured | Keeps daily life running while you heal |

Use this comparison to decide which costs to document first; the next section explains medical and rehab documentation in more detail.

Which Medical Expenses and Rehabilitation Costs Are Covered by PIP?

PIP generally pays for medically necessary services related to the crash: ambulance rides, emergency care, hospital stays, doctor visits, scans, and prescriptions billed as accident‑related. Rehab like physical and occupational therapy is usually eligible when ordered for accident injuries. Strong claims include physician orders, treatment plans, and itemized provider invoices that reference the motor vehicle incident. Ask providers to mark treatments as accident‑related and request itemized bills and notes — clear billing codes and timely submissions help prevent denials.

Keeping consistent medical records and receipts makes reimbursement smoother and reduces disputes over whether care was linked to the accident. We cover record‑keeping in the documentation checklist below.

How Does PIP Cover Lost Wages and Essential Services?

PIP can reimburse part of the income you lose if an injury keeps you from working. Insurers usually want proof such as pay stubs, employer letters, or payroll records to verify lost wages. Benefits are often calculated as a percentage of pre‑injury earnings or a capped weekly amount, so documentation showing time off and medical necessity is key. Essential services — for example, paying for childcare or housekeeping because you can’t do those tasks — can be reimbursable with receipts, service invoices, and a provider’s note explaining the need. Clear, dated evidence of lost time and paid services increases the chance of timely payment and ties benefits to real economic impact.

With that in mind, the next section walks through a step‑by‑step PIP claim process and how Prime Time Collision Center can help.

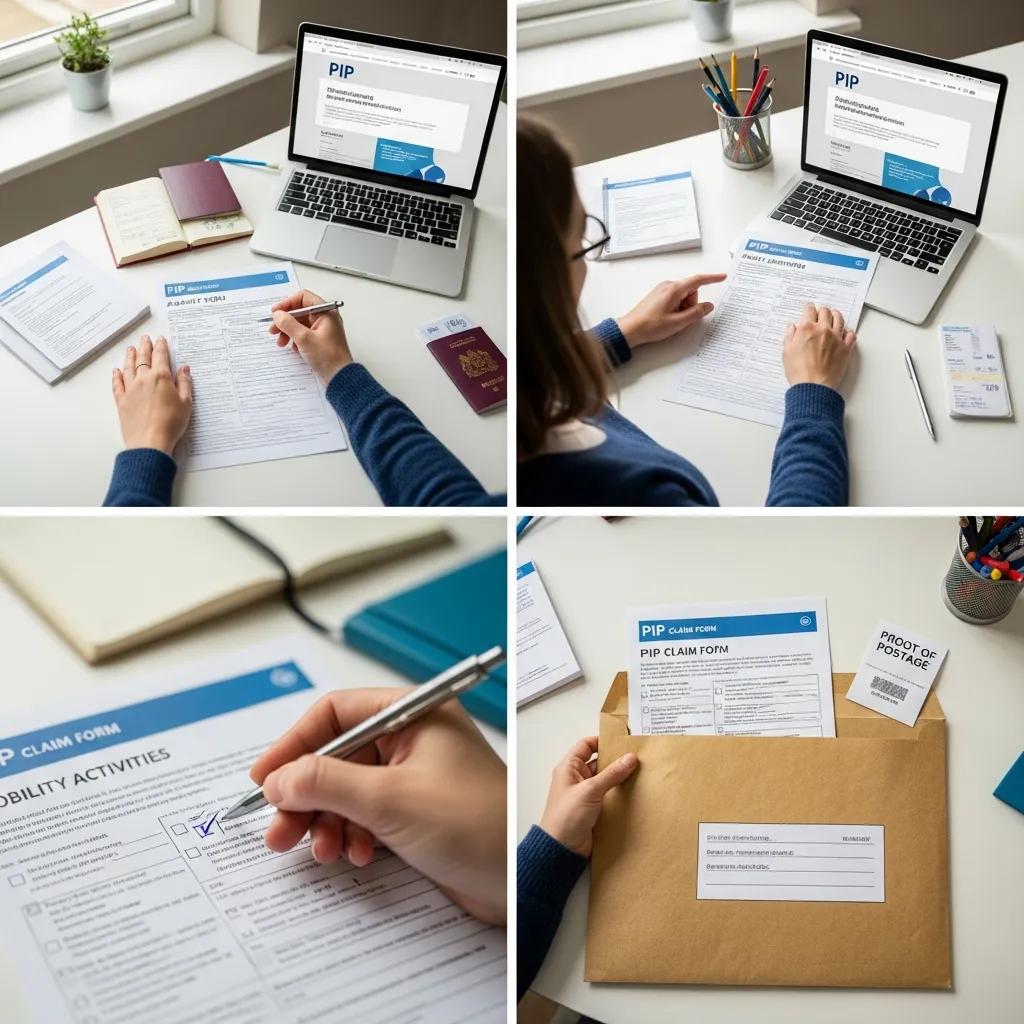

How to File a PIP Claim: Step‑by‑Step Process with Prime Time Collision Center

Filing a PIP claim starts with safety and documentation, then moves through insurer notification, medical care, and submission of required paperwork to link expenses to the crash. First, make sure everyone is safe and get emergency care if needed. Document the scene with photos and collect witness contacts — these early steps support both medical care and any PIP claim. Next, notify your auto insurer quickly and ask for the insurer’s PIP claim form or instructions. Follow up with itemized medical bills, employer verification for lost wages, and receipts for services. Prime Time Collision Center can help by providing a free estimate, arranging free 24/7 towing when necessary, and communicating with insurers about repair scope so you can focus on recovery.

Here’s a concise checklist to follow after an accident to file a PIP claim effectively.

- Report the accident to your insurer and request PIP claim forms within the 24–72 hour window your policy may require.

- Get a medical evaluation and collect itemized bills and provider notes referencing the vehicle accident.

- Document the scene: photos, police report number, witness contacts, and vehicle damage notes.

- Assemble proof of lost wages: employer letters, pay stubs, or payroll records.

- Submit bills, invoices, and supporting documents to your insurer and check in regularly for status updates.

- Once medical issues are stable, coordinate vehicle repair scheduling and estimates with your repair facility and insurer.

These steps create a repeatable workflow that protects both your medical recovery and your chance for reimbursement. The table below lists the key documents and who provides them.

| Document/Step | Why It’s Needed | Who Provides It |

|---|---|---|

| Police Report | Verifies incident details and participants | Law enforcement at the scene |

| Medical Records & Itemized Bills | Links treatment to the accident and supports PIP payment | Treating medical providers |

| Employer Wage Verification | Proves lost earnings for reimbursement | Your employer or payroll department |

| Photos and Witness Info | Corroborates accident circumstances and injuries | You or bystanders |

| Repair Estimate | Documents vehicle damage and supports insurer communication | Auto body shop (repair facility) |

This checklist clarifies who should provide each item and speeds your claim preparation. The next sections explain documentation details and how Prime Time helps with liaison and OEM repair coordination.

What Documentation Is Needed to File a PIP Claim?

A strong PIP claim usually includes: the police report or accident report number; itemized medical invoices and provider notes tying care to the accident; and proof of lost wages like recent pay stubs or an employer letter. Photos of the crash scene, vehicle damage, and visible injuries strengthen causation and help adjusters understand treatment timelines. Keep receipts for essential services (childcare, housekeeping) and prescriptions with clear dates that link them to your recovery. Organize everything chronologically and keep copies — this simplifies insurer follow‑up and any appeal if a claim is denied.

After you assemble documents, submit them per your insurer’s directions and keep regular contact. Prime Time can help reduce administrative burden by coordinating repair estimates and insurer communication.

How Does Prime Time Collision Assist with Insurance Claims and OEM Certified Repairs?

Prime Time Collision Center offers free estimates and 24/7 towing to reduce immediate stress after a crash and get your vehicle to experienced technicians quickly. We work with all major insurers to coordinate paperwork and claim communications, which can help speed repair approvals and clarify OEM parts needs for safety systems. Our shop focuses on factory‑quality, OEM‑certified repairs performed by I‑CAR Platinum Certified Technicians to preserve safety features and long‑term value while meeting insurer and manufacturer requirements. Local drivers in Glendale and nearby communities benefit from our claim assistance so they can focus on medical recovery while we handle repair logistics and insurer liaison.

By aligning repair timelines and documentation with the accident record, Prime Time helps reduce avoidable delays and supports a smoother overall recovery.

PIP Coverage in California and No‑Fault Insurance States: What Vehicle Owners Should Know

State law determines whether PIP is required, how much it pays, filing deadlines, and subrogation rules. California generally does not require PIP; many California drivers rely on MedPay or health insurance for collision‑related medical bills. If an accident happens in a state that mandates PIP, those no‑fault rules may apply to that crash — which can complicate cross‑jurisdictional reimbursement. Check your state’s department of insurance guidance and your policy before travel to avoid surprises. The following sections explain how California handles MedPay and how state differences can affect claims.

The table below summarizes key differences between PIP and MedPay for drivers who live in or travel between multiple states.

| Coverage Type | Required/Optional | Typical Limits | Coordination Notes |

|---|---|---|---|

| PIP (No‑Fault States) | Often required | Varies by state; may include medical + lost wages | Primary payer in no‑fault states; subrogation possible |

| MedPay | Optional in many states | Usually lower limits focused on medical only | Often supplements health insurance; typically no lost wages |

| Liability Coverage | Required statewide | Pays others for injuries/damage you cause | Not for your own medical bills unless a third‑party claim succeeds |

Is PIP Required in California and How Does MedPay Relate?

California doesn’t generally require PIP on auto policies. Instead, many drivers use MedPay and health insurance for immediate medical bills after a collision. MedPay helps pay accident‑related medical costs regardless of fault, but it usually won’t cover lost wages or household services that PIP might in other states. Given policy and state variation, California drivers should check their declarations page to see if MedPay or similar coverage is included and verify how it coordinates with health insurance. If you’re unsure which coverage applies, gather documentation and contact your insurer or a local collision partner for help navigating the claim process.

Knowing this difference helps Californians anticipate gaps in income replacement or service reimbursements and plan accordingly.

How Do State Requirements Affect Your PIP Benefits and Claims?

State rules change benefit limits, payment priority, filing timelines, and subrogation rights — so the same crash can produce different outcomes depending on where it happens. For instance, a no‑fault state may allow immediate PIP payments for rehab and lost wages, while a fault state might require a third‑party claim or settlement before full compensation is available. If you’re injured while traveling, file with both your home insurer and the insurer for the state where the crash occurred, and keep meticulous records of which laws apply. When in doubt, document everything and ask an experienced local repair center or claims liaison for help so you don’t miss deadlines or evidence requirements.

Confirming policy terms and state law early is the best way to protect your right to PIP or related benefits.

Why Choose Prime Time Collision Center for Your PIP‑Covered Collision Repairs?

Picking a repair partner that understands insurance workflows and performs OEM‑quality repairs reduces friction between medical and repair claims, and helps preserve safety systems and resale value after an accident. Prime Time Collision Center provides factory‑quality, OEM‑certified repairs and works with all major insurers to coordinate timelines and documentation. Our technicians are I‑CAR Platinum Certified, and we serve Glendale, Burbank, Pasadena, and Los Angeles with free 24/7 towing and free estimates — all designed to lower stress for injured drivers. By combining claims assistance, certified repair standards, and local service, Prime Time helps keep medical and repair records aligned so claims move more smoothly.

Here are the practical benefits customers see when repairs and claims are handled with an OEM focus and insurer coordination:

- Less paperwork for you: We liaise with insurers to clarify estimates and repair scope.

- Safety preserved: OEM parts and certified technicians help maintain factory safety calibrations.

- Convenience: Free 24/7 towing and free estimates remove immediate logistical hurdles.

How Do I‑CAR Platinum Certified Technicians Ensure Quality OEM Certified Repairs?

I‑CAR Platinum certification means technicians have advanced training in modern collision repair practices, including structural procedures, electronics, and advanced driver‑assistance system calibration. Certified techs follow manufacturer repair procedures and use OEM parts when required so your vehicle’s safety features and structure are restored properly. That lowers the risk of improper repairs that could affect safety or resale value, and helps meet insurer and manufacturer warranty expectations. Choosing a facility with certified staff adds confidence that repairs meet today’s safety and quality standards.

Certified repair records — including itemized OEM parts lists and technician notes — also strengthen claims documentation and help insurers finalize approvals.

What Are the Benefits of Prime Time’s Insurance Claim Assistance and Free Services?

Our free estimates and 24/7 towing ease the immediate burden after a crash by getting your vehicle to a certified shop quickly and providing a clear damage assessment for insurers. We work with all major insurance companies to submit repair estimates and technical details insurers often request, which can speed approvals and reduce back‑and‑forth. Factory‑quality OEM repairs by I‑CAR Platinum Certified Technicians preserve safety systems and vehicle value while aligning repair documentation with insurer requirements. For Glendale area residents, this combination simplifies both the physical repairs and the administrative side so you can focus on health and recovery.

These coordinated services are especially helpful when PIP is covering medical costs while repair approvals are pending — our documentation supports both insurance tracks.

Frequently Asked Questions

1. What should I do immediately after an accident to ensure my PIP claim is successful?

After an accident, put safety first and get medical help if needed. Take photos, collect witness info, and obtain a police report. Notify your insurance company promptly and request PIP claim forms. Keep clear records of all communications and expenses related to the crash — detailed documentation makes claims easier to process and improves the chance of a successful outcome.

2. How long do I have to file a PIP claim after an accident?

Filing timeframes vary by state and insurer, so file as soon as possible — commonly within 30 days, though some states or policies require shorter windows. Waiting can risk denial, so check your policy and state rules and act quickly to protect your benefits.

3. Can I receive PIP benefits if I was a passenger in someone else’s vehicle?

Yes. If you were a passenger, you may be eligible for PIP under the vehicle’s policy depending on that policy and state law. PIP often covers occupants of the insured vehicle, including passengers. Always verify eligibility with the policy that applies to the vehicle you were in.

4. How does PIP coverage interact with my health insurance?

PIP’s interaction with health insurance depends on state law and policy terms. In many cases PIP pays first for accident‑related medical care, then health insurance covers remaining costs according to coordination‑of‑benefits rules. Some policies have different rules, so review your coverage and talk to your insurer to understand how payments will be handled in your situation.

5. What happens if my PIP claim is denied?

If a claim is denied, read the denial letter to learn why — common reasons are missing documentation, late filing, or lack of coverage. Gather any additional evidence, submit an appeal if appropriate, and consider consulting a claims liaison or legal advisor for help. Often, supplying the right records or clarifying treatment links to the accident can overturn a denial.

6. Are there any specific documentation requirements for PIP claims?

Yes. Typical requirements include a police report, itemized medical bills, proof of lost wages, and receipts for essential services. Medical records that link treatment to the accident are especially important. Organize and submit these documents promptly and keep copies for your records to streamline the claims process.

7. Can I switch my PIP coverage to another insurance provider?

Yes — you can change providers, but do it carefully. Compare coverage options, limits, and costs before switching, and make sure there’s no gap between policies. Notify your current insurer to cancel your old policy only after the new one is active to keep continuous protection.

Does PIP Cover My Deductible and Can I Choose My Repair Shop?

PIP is meant to cover medical and related personal expenses and typically does not pay collision deductibles, which are tied to physical damage coverage. You usually have the right to choose your repair shop, but some insurers have preferred networks or may request documentation to approve an independent facility; rights differ by policy and state. If you want OEM‑certified work and insurer cooperation, choose a repair partner that documents repairs and communicates directly with adjusters. For local support with insurer communication and free estimates that help both medical and repair claims, contact a certified shop that offers claims coordination.

This helps clarify which coverage pays for what and what to do if you want a specific repair facility.

What Are Common Limitations and Exclusions of PIP Coverage?

Common exclusions include property damage, pre‑existing conditions not aggravated by the accident, and pain‑and‑suffering or punitive damages — those are typically outside PIP and handled by liability claims or other policies. Insurers often require proof that treatment is linked to the crash; if you delay filing or miss documentation deadlines, benefits can be denied. If a claim is denied, review the insurer’s reasons, collect supporting documentation, and consult medical providers or a claims liaison to address gaps.

These exclusions show why reading your policy and documenting everything after an accident are essential to a successful claim.

- Gather records quickly: Early evidence improves outcomes and prevents missed deadlines.

- Document causation clearly: Medical notes that tie treatment to the crash reduce disputes over necessity.

- Coordinate providers and repair shops: Consistent documentation across medical and repair records shortens approval timelines.

Following these three practical steps helps you avoid common pitfalls and supports both PIP reimbursements and insurer‑approved repairs.

With this information, you should have a clear framework for understanding PIP coverage, assembling documentation, and working with repair partners to streamline claims and OEM‑quality restorations.

Conclusion

Understanding Personal Injury Protection (PIP) gives you an advantage when navigating medical bills and claims after an accident. Knowing what PIP can cover — medical care, lost wages, and essential services — helps protect your finances while you recover. Working with a knowledgeable repair partner like Prime Time Collision Center can simplify paperwork, coordinate repairs, and keep your claim moving. Ready to take the next step? Explore our services and resources or contact us for help with estimates, towing, and claim coordination.