Auto Insurance Deductibles — A Clear, Practical Guide to Managing Collision Repair Costs

Your insurance deductible is the amount you pay out of pocket before your carrier covers the rest of a repair. Knowing how deductibles work shapes choices about filing claims, scheduling repairs, and the total you’ll pay. This guide walks you through what deductibles are, how collision and comprehensive coverages differ, and the steps to take after an accident so you can make clear, confident decisions. You’ll also learn how choosing a higher or lower deductible affects premiums and risk, why OEM-certified repairs matter for safety and resale value, and how a local shop can help manage insurance coordination. We use plain examples, side-by-side comparisons, and step-by-step checklists to make the process easy to follow.

What Is an Auto Insurance Deductible?

A deductible is a set dollar amount you agree to pay when you file a covered claim; your insurer pays the remainder up to your policy limits. It’s a cost-sharing tool that helps keep premiums lower by avoiding small claims. Deductibles differ by coverage type — for example, collision versus comprehensive — so choosing the right amount means balancing lower monthly premiums against the risk of higher out-of-pocket costs after an accident. Understanding that trade-off makes it easier to decide whether to file a claim or handle a small repair yourself. Below we define the common deductible types and show when each applies.

How Do Collision and Comprehensive Deductibles Differ?

Collision and comprehensive are two common deductible categories that apply to different kinds of losses and affect who pays and when. Collision coverage and its deductible apply when your vehicle hits another car or object. Comprehensive covers non-impact events like theft, vandalism, weather damage, or a fallen tree. The table below lays out when each deductible typically applies and gives examples so you can quickly identify which one you’re facing after a loss.

| Deductible Type | When It Applies | Typical Example |

|---|---|---|

| Collision Deductible | Damage from hitting another vehicle or an object | Fixing a bumper after hitting a pole |

| Comprehensive Deductible | Non-collision losses like weather, theft, or vandalism | Replacing a window after a break-in |

| Uninsured Motorist Deductible | When the other driver lacks insurance (policy-dependent) | Hit-and-run damage or injuries |

That comparison shows collision deductibles cover impact repairs while comprehensive covers environmental or non-impact damage. Knowing the difference helps you report the correct claim type and estimate likely out-of-pocket costs. Next, we explain how fault and subrogation can change who ultimately pays the deductible.

What Are No-Fault and At-Fault Deductibles?

“At-fault” versus “no-fault” affects who pays the deductible initially and whether you might get reimbursed. If you’re found at fault, you’ll usually pay your deductible up front and your insurer may seek reimbursement from the other driver’s carrier. That subrogation process can take weeks or months. In no-fault states or when using no-fault coverages, deductible rules can differ — some medical or property payments may bypass the usual fault process. Because reimbursement timing is uncertain, document the accident carefully and keep repair receipts to support subrogation or any recovery attempts.

How Do Car Insurance Deductibles Work After an Accident?

After an accident, deductibles affect the payment phase: you file a claim, the vehicle is inspected and estimated, and your insurer pays for covered repairs minus your deductible — which you’re responsible for paying the shop. The process connects four players: you (the policyholder), the repair shop, your insurer, and sometimes the at-fault party’s carrier. Knowing the sequence helps avoid surprises. Below is a typical workflow from scene to finished repair, showing exactly where the deductible fits.

- Ensure Safety and Document the Scene: Make sure everyone’s safe, exchange information, take photos, and note witnesses.

- Report the Claim to Your Insurer: Open a claim quickly and share photos and details while they’re fresh.

- Obtain an Estimate: Bring the car to a qualified shop for a written repair estimate; the shop often coordinates with the insurer.

- Insurer Adjuster Review: An adjuster reviews the estimate and authorizes covered work, noting your deductible.

- Deductible Payment and Repair Authorization: You pay the deductible to the shop or insurer as required so repairs can begin.

- Repair Completion and Payment Settlement: The insurer pays the approved amount directly to the shop; if subrogation succeeds, you may be reimbursed later.

This timeline shows deductible payment usually comes before work starts unless other arrangements are made. The next section explains how Prime Time helps with claims and payment coordination.

What Are the Steps to Filing a Claim with Prime Time Collision Center?

At Prime Time Collision Center we streamline the claim process: we inspect damage and provide a free, insurer-ready estimate, communicate directly with your carrier, and coordinate towing when needed. First, we perform a detailed damage assessment and produce a clear estimate that speeds adjuster reviews. Then we talk with insurers about covered repairs, ADAS calibration, and parts sourcing, and schedule work once deductible and authorization are set. Finally, we collect the deductible and perform OEM-quality repairs using I-CAR Platinum-trained technicians, keeping safety and timelines front and center while explaining reimbursement expectations.

How Does Paying Your Deductible Affect Your Repair Timeline?

Paying your deductible promptly usually helps get parts ordered and repairs scheduled faster because the shop can move forward without waiting on payments or fault decisions. If fault is disputed or a third party accepts responsibility, subrogation could reimburse your deductible — but that process can take weeks, so shops often ask customers to pay their deductible to start repairs. For small repairs that fall under the deductible, many customers choose to pay out of pocket to avoid claim-related delays and preserve their claims history. In short: paying the deductible quickly often gets you back on the road sooner.

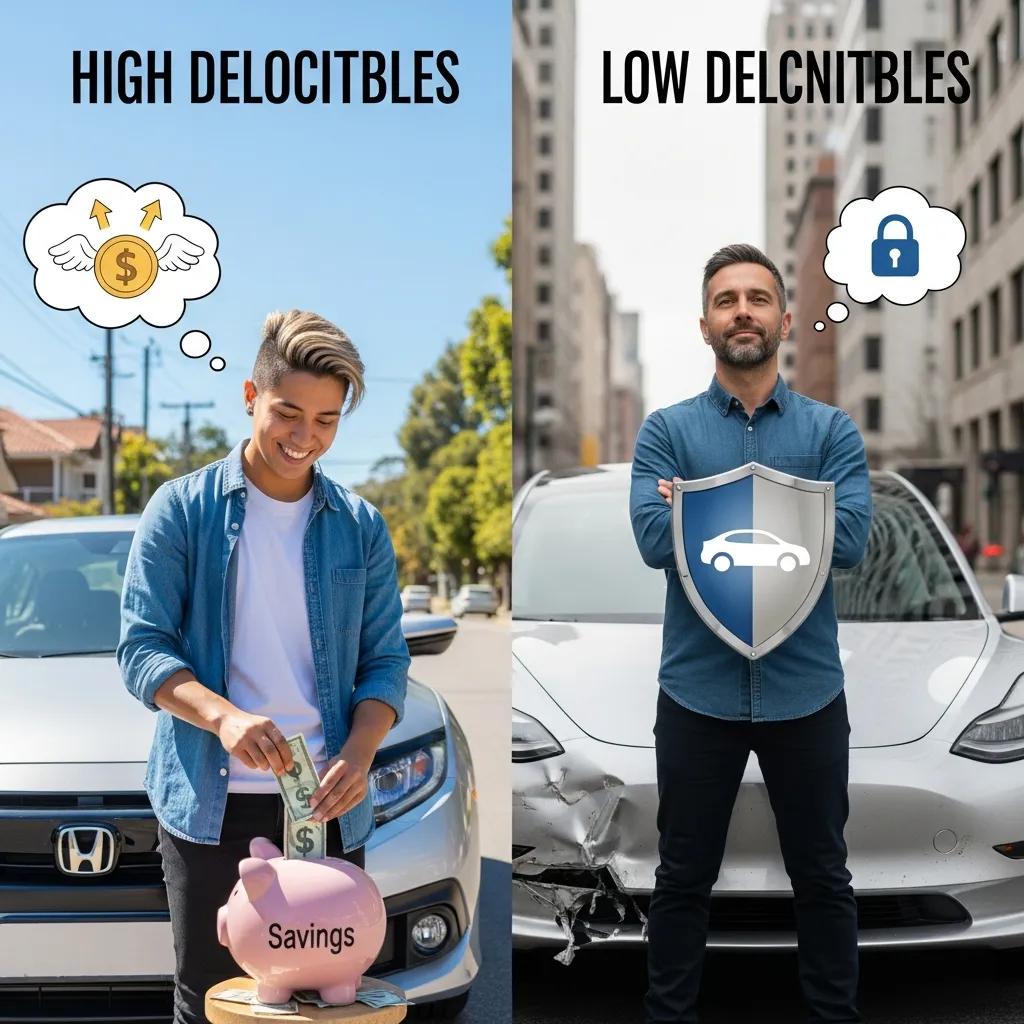

High vs. Low Auto Insurance Deductible: Which Should You Choose?

Choosing a high or low deductible is a trade-off between lower premiums and higher out-of-pocket risk. A high deductible lowers yearly premiums and makes sense if you rarely file claims and have savings to cover repairs. A low deductible raises premiums but reduces the money you’d pay after a claim — good for daily commuters, leased vehicles, or drivers who prefer predictable costs. The table below compares the options and suggests which driver types usually pick each.

| Option | Characteristic | Ideal Driver Profile |

|---|---|---|

| High Deductible | Lower premium, higher out-of-pocket per claim | Infrequent drivers with emergency savings |

| Low Deductible | Higher premium, lower per-claim cost | Daily commuters, leased or high-value vehicles |

| Medium Deductible | Balanced premium and risk | Drivers wanting a middle ground |

For example: if raising your deductible saves $300 a year in premiums, skipping small repairs and paying out of pocket could be the smarter choice — but frequent claims quickly wipe out those savings. The next sections break down the pros and cons so you can decide what fits your budget and driving habits.

What Are the Pros and Cons of High Deductibles?

High deductibles lower your premiums and discourage small claims that can raise rates, but they also mean larger out-of-pocket bills after a crash and the risk of delaying needed repairs if funds aren’t available. For drivers who rarely file and have an emergency fund, the annual premium savings can add up. If you don’t have accessible cash, a high deductible could create unsafe delays in repairs. Before choosing a high deductible, check your savings and how much risk you’re willing to accept.

How Do Low Deductibles Impact Your Premiums and Out-of-Pocket Costs?

Low deductibles reduce what you pay at a claim and encourage timely use of insured repair facilities, but they increase annual premiums and may lead to more frequent small claims. For leased or financed cars — where insurer-approved repairs are often required — a low deductible lowers the chance of surprise bills. If you prefer predictable monthly expenses or you drive a high-value vehicle, a low deductible can be worth the extra premium.

Why Choose OEM Certified Repairs Despite Your Deductible?

Spending your deductible on OEM-certified repairs can cost more upfront, but it restores safety systems, preserves fit and finish, and reduces the chance of future mechanical or structural problems. OEM procedures ensure correct structural alignment, ADAS calibration, and manufacturer-grade parts — all important for safety, warranty concerns, and resale value. Investing in proper OEM work often avoids repeat visits and future claims related to substandard repairs. Here are the main reasons drivers choose OEM-certified repairs after a collision.

- Safety Integrity: OEM parts and repair sequences restore factory crash performance and protect occupants.

- Advanced Systems Support: ADAS, sensors, and EV batteries require manufacturer-aligned processes and calibration.

- Resale and Warranty: OEM repairs help maintain resale value and reduce disputes over workmanship.

Spending deductible dollars on OEM-certified work is an investment in long-term reliability and safety — especially as modern cars rely heavily on electronics and precise structural repairs.

How Do I-CAR Platinum Certified Technicians Ensure Quality Repairs?

I-CAR Platinum certification means the shop keeps technicians up to date with advanced training and the latest repair procedures. Technicians with this credential handle structural repairs, frame alignment, and ADAS calibrations to manufacturer specs. They use proper tooling and document repairs to support insurer approvals and warranties. For you, that means a higher likelihood your vehicle will perform correctly after repair and a lower chance of follow-up problems tied to workmanship.

What Are the Long-Term Benefits of OEM Certified Repairs?

Choosing OEM-certified repairs protects vehicle integrity and crashworthiness, reducing the risk of recurring issues from incorrect parts or techniques. Over time, OEM work helps preserve resale value, simplifies future inspections, and cuts down on insurer disputes about part quality or workmanship. For example, one vehicle that received OEM parts and ADAS calibration avoided repeated sensor failures that would otherwise have led to multiple claims and rising premiums. That kind of long-term reliability is often worth the initial deductible investment.

Frequently Asked Questions

What Should I Do If I Can’t Afford My Deductible?

If you can’t pay the deductible right away, talk to your repair shop — many offer payment plans or financing options. Check your policy for deductible waivers (for example, some glass claims) or whether uninsured motorist coverage applies. Also review your budget and any emergency funds to find a practical short-term solution.

Can I Change My Deductible After an Accident?

Usually you can’t change your deductible mid-claim — changes typically take effect at renewal. Talk with your insurer about options for future policies, but expect any deductible adjustments to affect your next policy period and your premium.

How Do I Know If My Deductible Is Too High or Too Low?

Look at your savings, driving habits, and vehicle value. If you can comfortably cover a larger repair from savings and you rarely file claims, a higher deductible may save money. If you want predictable costs or drive a leased or high-value car, a lower deductible might be better. Balance what you can afford today against potential future expenses.

What If My Insurance Company Denies My Claim?

If a claim is denied, read the denial letter to understand why — common reasons include lack of coverage, exclusions, or missed deadlines. You can appeal: gather photos, witness statements, and repair estimates, then talk with your insurer. If needed, consider an attorney or insurance advocate to help with the appeal.

Are There Any Circumstances Where I Won’t Have to Pay a Deductible?

Yes. Some policies waive the deductible for specific claims (like certain glass repairs), and in rare cases other coverages (like certain uninsured motorist benefits) may apply without a deductible. Policy terms vary, so check your documents and ask your insurer to confirm any exceptions.

How Can I Prepare for a Claim to Minimize Delays?

Have your insurance card, photos, witness details, and any police reports ready. Report the incident to your insurer promptly and provide clear documentation. Using a shop experienced with insurance claims — like Prime Time — also speeds the process because they can prepare an insurer-ready estimate and communicate directly with adjusters.

Do I Have to Pay a Deductible if the Accident Wasn’t My Fault?

Usually, yes: you’ll often pay your deductible up front because your insurer handles the claim and then pursues the at-fault party’s carrier for reimbursement through subrogation. If that recovery succeeds, you may get your deductible back — but timing varies and reimbursement isn’t guaranteed before repairs. To support subrogation, document the scene, collect witness information, and keep detailed repair invoices. Prime Time Collision Center helps by providing thorough estimates and documentation to support recovery when another party is liable.

What Happens If Repair Costs Are Less Than My Deductible?

If the repair cost is below your deductible, the insurer usually won’t pay — you’ll cover the bill out of pocket and may decide not to file a claim. Filing small claims can sometimes affect premiums, so paying out of pocket is often the best option. If another party is at fault, you can pursue reimbursement directly from them or via small-claims court. We recommend getting an estimate first to compare repair costs with your deductible before deciding.

How Prime Time Collision Center Supports You Through Insurance Claims and Deductible Payments

Prime Time Collision Center offers services to reduce headache and speed repairs: free estimates, direct insurer coordination, 24/7 towing referrals, and OEM-certified repairs backed by a lifetime workmanship warranty. We start with a detailed, insurer-ready estimate that documents damage, required parts, and any ADAS or EV-specific needs to shorten adjuster reviews and limit disputes. We work with major insurance carriers to resolve authorization questions and outline deductible payment options so you know when payment is due and how subrogation might proceed. If you need immediate help after an accident, call (818) 396-4997 or visit us at 6010 San Fernando Rd, Glendale, CA 91202 to request a free estimate and towing coordination.

What Insurance Companies Does Prime Time Work With?

We work with all major insurance companies to smooth the claim process. Our inspectors and adjuster-facing documentation clarify covered repairs and parts sourcing, which helps speed approvals for OEM parts and necessary calibrations. Customers should confirm any carrier-specific requirements, and our team will advise on next steps so repair scheduling and deductible timing line up. This coordination reduces surprises and keeps projects moving.

How Can I Get a Free Estimate and 24/7 Towing Assistance?

Request a free estimate by calling the shop or bringing the vehicle in for an inspection. Our estimator documents damage and prepares a comprehensive, insurer-ready estimate. For 24/7 towing, we coordinate referrals so your car is brought to a secure facility for intake and storage before repair. When you call, be ready to describe the incident, give vehicle details, and note safety concerns or fluid leaks so we can prioritize towing. After intake, the estimator will explain the repair process and when the deductible will be collected.

- Prepare Documentation: Have your insurance card, photos, and incident details ready when you call.

- Schedule Intake: Arrange towing or bring the vehicle in for a free estimate and inspection.

- Authorize Repairs: We coordinate with your insurer and outline deductible payment steps before repairs begin.

These steps minimize delays and ensure OEM-quality repairs with full documentation to support insurance processing and any potential reimbursement.

Conclusion

Understanding deductibles helps you make smarter choices after a collision — from whether to file a claim to where you spend your deductible dollars. Knowing the difference between collision and comprehensive coverage, and the trade-offs of high versus low deductibles, makes the process less stressful. Choosing a trusted shop like Prime Time Collision Center can simplify claims, protect your vehicle’s safety and value, and get you back on the road faster. Contact us for a free estimate and let our team guide you through deductible questions and the repair process.